" FDA Takes Steps Aimed at Improving Quality, Safety and Efficacy of Sunscreens."Īssociation of International Certified Professional Accountants & The Chartered Institute of Management Accountants.

" The Peace Corps: Overview and Issues,". " CARES Act Arts and Cultural Provisions,". 748 the Coronavirus Aid, Relief, and Economic Security Act,". United States Senate Committee on Appropriations. " General State and Local Fiscal Assistance and COVID-19: Background and Available Data," Refer to "Summary." " Breakdown of the Coronavirus Aid, Relief, and Economic Security (CARES) Act."Ĭongressional Research Service. " Cares Act - Bolstering Health Care Response." " Relief for Taxpayers Affected by COVID-19 Who Take Distributions or Loans From Retirement Plans."

" Deferral of Employment Tax Deposits and Payments Through December 31, 2020." " COVID-19-Related Employee Retention Credits: Overview." " Treasury’s Exchange Stabilization Fund and COVID-19." " COVID-19 Relief Assistance to Small Businesses: Issues and Policy Options,". " COVID-19 Relief Assistance to Small Businesses: Issues and Policy Options," Pages 2, 23.Ĭongressional Research Service. " Cares Act FAQs."Ĭongressional Research Service.

#Corona virus stimulus how to#

" Paycheck Protection Program How To Calculate Maximum Loan Amounts – By Business Type." " With $349 Billion in Emergency Small Business Capital Cleared, Treasury and SBA Begin Unprecedented Public-Private Mobilization Effort To Distribute Funds." " Biden, President of the United States, et al. " Fact Sheet: President Biden Announces New Actions To Provide Debt Relief and Support for Student Loan Borrowers." “ FACT SHEET: The Biden-Harris Administration Launches the SAVE Plan, the Most Affordable Student Loan Repayment Plan Ever To Lower Monthly Payments for Millions of Borrowers.” " COVID-19 Emergency Relief and Federal Student Aid." " Unemployment Insurance (UI) Benefits: Permanent-Law Programs and the COVID-19 Pandemic Response," Summary Page.įederal Student Aid. " New COVID-19 Unemployment Benefits: Answering Common Questions."Ĭongressional Service Research. Department of Labor Announces New Guidance to States on Unemployment Insurance Programs." New York State Department of Labor " Continued Assistance for Unemployed Workers Act of 2020 FAQS (Updated March 2021)." " Unemployment Insurance (UI) Benefits: Permanent-Law Programs and the COVID-19 Pandemic Response,". Department of Labor Issues Guidance on Federal Pandemic Unemployment Compensation and Mixed Earner Unemployment Compensation."Ĭongressional Service Research. Department of Health and Human Services."

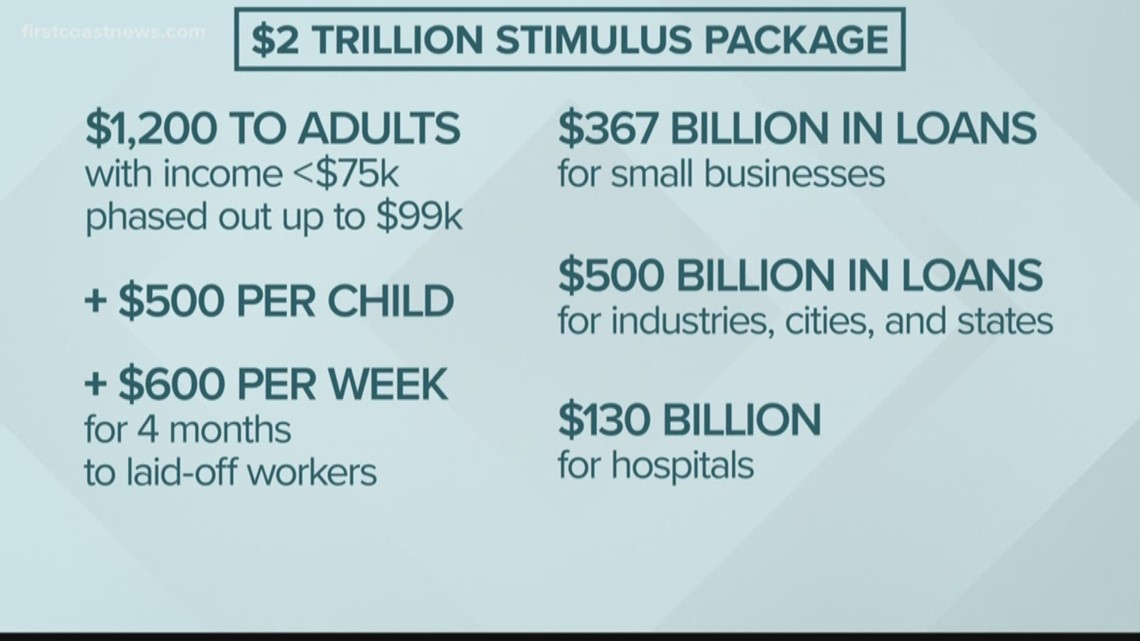

" Pandemic-Related Provisions Expiring in the 117th Congress." " A Visualization of the CARES Act."Ĭongressional Service Research. " American Rescue Plan Act (ARPA) Funding."Ĭommittee for a Responsible Federal Budget. " The Economic Impact of the American Recovery and Reinvestment Act Five Years Later,". " Consolidated Appropriations Act, 2021 – Highlights of Tax Issues Impacting Farm Businesses." " United States: President Signs CARES Act in Response to Coronavirus Pandemic."įarm Office, Ohio State University Extension. It was signed into law on March 11, 2021, and some provisions expired on Sept. It extended or revised many of the benefits of the CARES Act, including rebates to taxpayers, benefits for the unemployed, and tax credits for parents.

0 kommentar(er)

0 kommentar(er)